The friend.tech case study: bad incentives lead to bad outcomes

Hi!

Welcome to Web3 Bits, where I share a few of the most interesting web3 bits for you to consumer over the weekend.

Today I'm going to dive into a case study of what friend.tech is getting wrong. If getting these thoughts in real time is interesting, you can join my telegram channel where I share thoughts and resources throughout the week.

Writings

The friend.tech case study: bad incentives lead to bad outcomes

Crypto economics deal with incentives, game theory and mechanism design because incentives matter. Good incentive designs lead to good mechanisms and product outcomes. Bad ones lead to the reverse. Despite the current hype about friend.tech, the incentives on the app have been misdesigned and will lead to bad outcomes.

There’s lots to learn here for builders as well as speculators. We’ll explore:

- Why and incentives should align with your product goals.

- How to evaluate the incentives

- Learning from history for applicable lessons

The goal of this case study isn’t to dunk on the friend.tech builders, rather to take a real life case study so that we can build better apps in the future. I’ll start with an overview of the product goals, narratives around friends.tech and then analyze the app and product flow in light of the incentives.

A friend.tech product goal evaluation

Friend.tech is an app that lets you buy ‘keys’ in people. Buying a key gives you access to a private chat with everyone else who owns a key. Prices are determined on a curve, the more buyers the higher price per key. This is a B2C social financial app — it’s core use case at the moment is connecting, investing and speculating. Apps like this are evaluated on a few key metrics: user engagement, usually in the form of DAU and WAUs as well as financial engagement in the forms of trades made. To succeed, they need to incentivize these types of users: DAU and WAUs who are engaged in the social and financial aspects of the app.

What are the narratives around friend.tech?

Every good product has a strong narrative, one that engages with the community and convinces people to give the product a try, to invest or simply to tag along. A few prevalent narratives have emerged around friend.tech:

- Creator financialization and community: creators suffer from bad economics. Patreon and every other platform takes a fee, it’s hard to monetize. Friend.tech lets creators be valued properly (through key price), and earn rewards by engaging with their community (through fees they receive every time their key is purchased).

- Friend.tech unlocks the ability to invest early in creators and reap the rewards. Just like an early stage startup investment.

- Speculation is a great way to bootstrap a user base.

Analyzing product and incentives in friend.tech

Friend.tech has three stake holders with different incentives that we’ll analyze: the app developers, creators and speculators/investors.

Friend.tech team

The app developers want to maximize DAU and WAU as well as financial engagement. More trades & more users = success. In terms of user cohorts, I assume that a classic social app experience, like snapchat or twitter, or a gaming breakdown can both work. Meaning that either large cohorts of mildly engaged DAU or WAU can succeed or tiny cohorts of highly engaged financial whales who trade incessantly, and generate the majority of fees.

Creators

Creators are interested in generating fees and building a community. Niether are mutually exclusive and in fact can come at the expense of each other, depending on the type of creator. A creator that relies on long term community building, like a writer, product builder who builds in public or artist who shares their journey benefits more from a long term community. Other creators who benefit from shorter transaction cycles, such as Onlyfan creators, could be interested in generating fees. It’s important to remember that creators generate fees only when their keys are traded. A creator doesn’t benefit at all if there’s no volume trading their shares, and their only benefit from someone holding their key is that it maintains a higher price floor, which, when shares are traded, increases the fee. Creators are thus incentivized to both generate more holders as well as more overall trading.

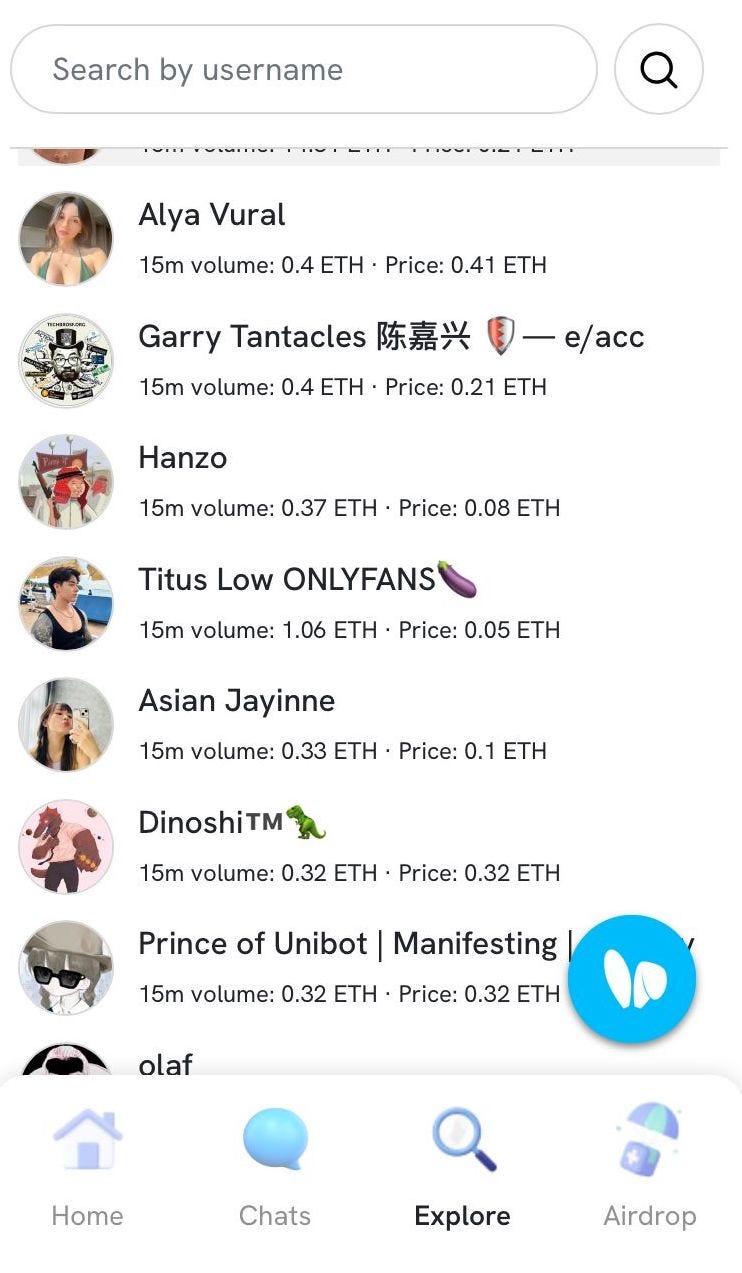

The key point is that once someone has bought your key, you as a creator aren’t very incentivized to maintain them — there’s no ongoing payment or subscription from them to you. Creators want more buyers than sellers, to increase the price of your key, but all things considered they’d rather a lower price, constantly traded than a high price that no one trades. Trades generate fees. Not holding. This incentives a very specific kind of creator, one who doesn’t build community or long term focus — rather a short transaction cycle. Which is why it’s no surprise to see a lot of OnlyFan creators in the 🔥 Trending tab.

|

It’s hard to overstate how badly designed the incentive mechanisms are for community building creators. Creators benefit from super fans who both offer emotional and financial support. The friend.tech financial model offers neither. Patreon and other subscription based platforms have succeeded for good reason. Ben Thompson from Stratechery, a leading creator economy publication, has long stipulated that ongoing memberships pay for ongoing content creation, not access to past work.

Subscriptions incentivize ongoing investment in a community by a creator. One and done purchases do not. Transaction fees incentivize turnover, not longevity.

Key buyers

Buyers can be broken down into three distinct groups: speculators, genuine fans and investors. Speculators want to buy low and sell high. They don’t care about creators or communities. They have a short time frame. They want to profit. Investors also want to make a profit but are more long term oriented. They want to invest in a creator early on and benefit from the rising stardom of that creator. They’re not real fans per se, but will stick around for the long term — as long as the thesis holds true for them. Genuine fans are different since they have much smaller financial incentives and want to engage with the creators they like.

At the moment friend.tech incentivizes only the first group: speculators. For genuine fans the friend.tech experience is worse on every metric than the industry status quo. Patreon and Discord already offer far better user experiences. There’s nothing better about the experience that makes it worthwhile for fans to show up. The one major caveat is that fans will show up where the creators they like are. In friend.tech, we’ve already established that the creators who fit are short term, transactional creators.

Investors have nothing to find on the platform. Despite the very catchy line that “imagine if you’d invested in Taylor Swift early on after she played in some club”, this only holds true if the platform is built for long term investing, holding and supporting of an artist. Friend.tech simply isn’t. Beyond the transactional nature of the relationship, which doesn’t incentivize long term community building on the platform, there’s also no connection between the creator’s upside and a key holders’.

Speculation is where the platform shines, and where it nails incentives. Financialization of ‘creators’, or speculating on them, tends itself to social influencers. Three main drivers for this are: people easily recognize them on the platform and can easier ‘asses’ the value in buying a key. Influencers can push their audience to buy their key and they’re incentivized to do so because it drives up volume of trading — something they’re rewarded with immediately in the form of fees.

Speculation also leads to quick dopamine hits, often something that genuine longterm fandom and investing doesn’t. There’s nothing quite like getting an immediate dopamine hit in the form of receiving trading fees on your keys or making a quick profitable trade. And this dopamine hit just incentivizes you to take this action again — but this isn’t long term community building. It’s all short term.

|

Summarizing incentives, speculation is the main activity being incentivized, both as a creator and a ‘collector’. The other main activity are transactional creators such as OnlyFans creators.

Lessons friend.tech shows we haven’t learned

Two main lessons we clearly haven’t learned in the last cycle are apparent in the narratives driving friend.tech to public awareness and in the discourse around it.

The first is that different users have very different motivations. As I explained in ‘Are tokens good for bootstrapping’:

Friend.tech incentivizes financial speculation driven users, not long term socially oriented ones. We know where this ends: in churning users. As there’s no real usage by actual creators, fans or long term investors, even the speculators get tired and drop off at some point. Once it begins it’s impossible to reverse, as speculators bail ship as fast as they entered.

The second lesson we haven’t learned is to learn from ‘history’. Even writing ‘history’ is ironic as the mistakes friend.tech and the crypto twitter influencers are making about it played out no more than two years ago. Last cycle we saw the rise of identical attempts. Bitclout let users speculate on twitter influencers. Social tokens let you buy in early into a creator or community. All failed not because of bad UI, but because being a content creator who builds a community with financial value is really really hard. Mixing up the user base and incentives is often a deathblow. Creators have to engage, provide value etc to justify their ‘financial valuation’. Most creators don’t want to do this because it’s time consuming and so drop out — leaving their token holders disappointed.

What we need to learn from friend.tech

Friend.tech has done a wonderful job showing how a B2C app can be built and onboard native crypto users. Built on Base, an Ethereum L2, the transaction fees are non existent. They nailed the speculative incentive design and showed how to build a good user experience for wallet onboarding and transaction abstraction. All very valuable learnings.

However we need to internalize the lessons of the past cycle and differentiate financial users from actual users. We need to build products with the right incentive mechanisms and we need to stop believe easy narratives with no tangible backing on the ground.

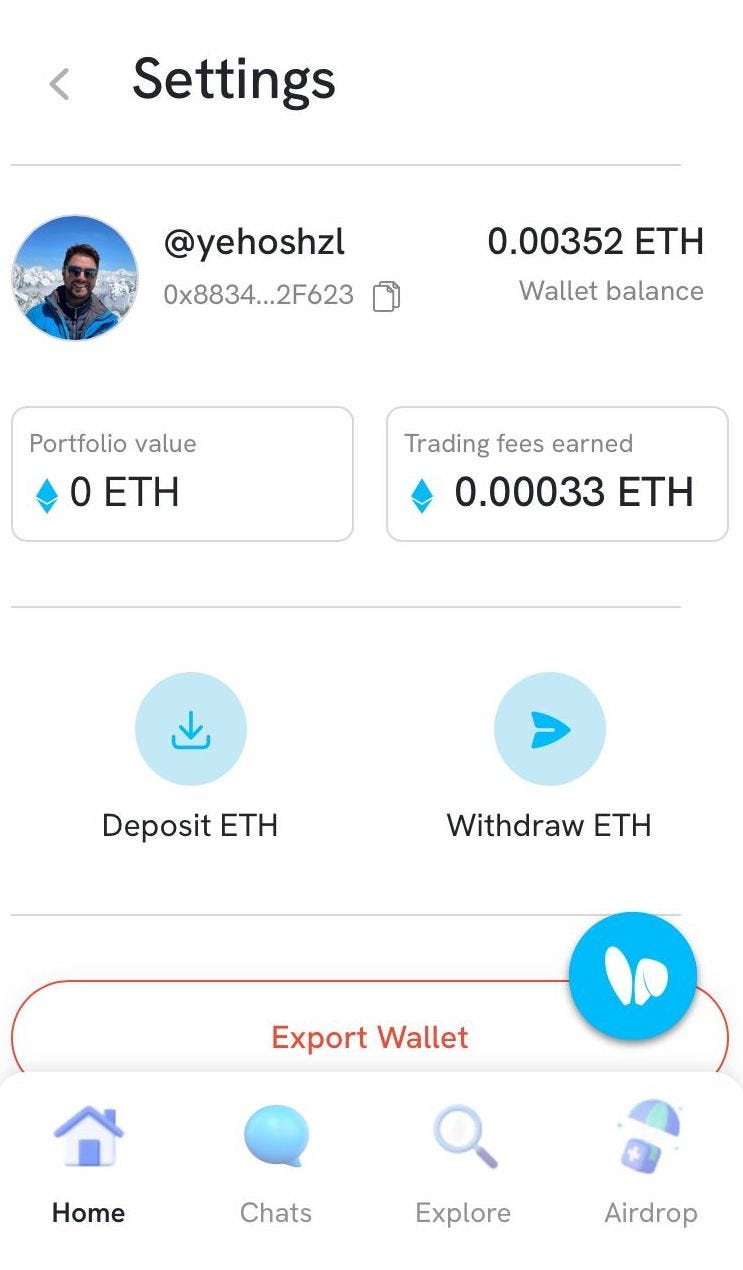

Hi! I'm Yosh, founder of Designing Tokenomics

I'm not great at writing bio's, but you can check out my work: 🎧 I host the Ethereum Audible podcast 💎 I write & teach tokenomics @ https://designingtokenomics.com 🏔 Build Alpe Audio: audio courses @ https://alpeaudio.com

Hi! Welcome to Web3 Bits, where I share a few of the most interesting web3 bits for you to consumer over the weekend. I've recently started sharing my investment journey (equities and crypto) on Substack, it's different, yet similar, to how I look at tokenomics. If investments and portfolio management interest you - you're welcome to read along here. I'm also adding a new corner to the web3 weekend bits: Frens corner! I'll be adding in an interesting snippet, article, podcast or piece of...

Hi! Welcome to Web3 Bits, where I share a few of the most interesting web3 bits for you to consumer over the weekend. This week I decided to dive into a new cool tokenomics model I've been having lots of fun with on Farcaster for the past month: $DEGEN. It's got a lot more going for it than just being a meme coin and good vibes. The team has implemented a few cool and simple mechanics that have really made things click. One of my key questions though are: is this sustainable and what needs to...

Hi! Welcome to Web3 Bits, where I share a few of the most interesting web3 bits for you to consumer over the weekend. It's been a good six months since my last missive. Life's been busy, but I'm glad to be back! If there's anything you'd like me to cover, write about or questions to answer - just let me know in a reply email and I'll get to it next time! The bull is back! In September last year I wrote about why I'm getting more bullish which turned out to be fairly prescient: Outside money...